Executive Summary World Robotics 2017 Industrial Robots From IFR

2016: Continued accelerating growth

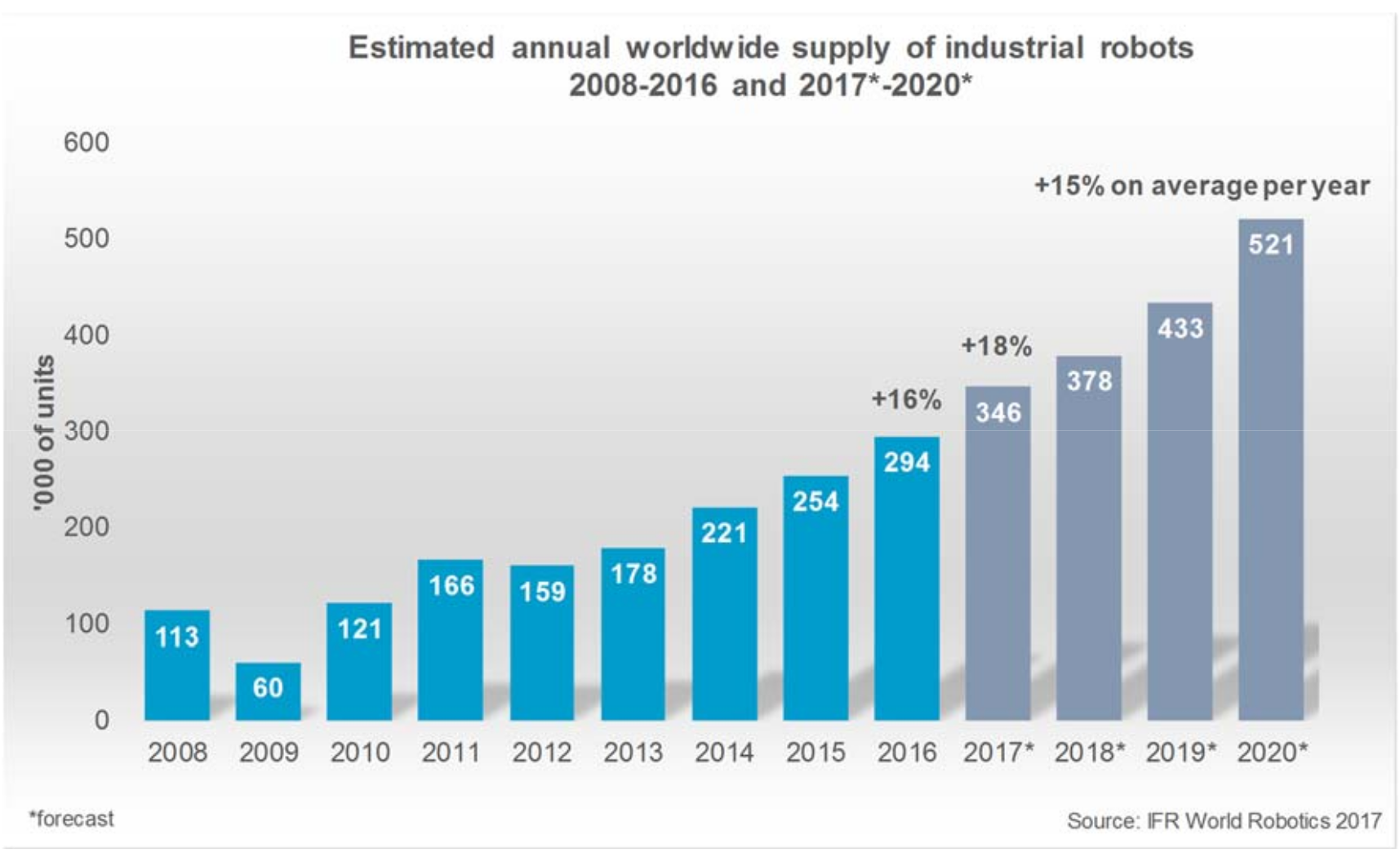

In 2016, robot sales increased by 16% to 294,312 units, a new peak for the fourth

year in a row. The main driver of the growth in 2016 was again – like in 2015 – the

electrical/electronics industry (+41%). Robot sales in the automotive industry increased,

like in 2015, at a rather moderate rate (by 6%) after a considerable increase between

2010 and 2014. The automotive industry is still the major customer of industrial robots

with a share of 35% of the total supply in 2016. The electrical/electronics industry has

been catching up, specially in 2015 and 2016, reaching a share of 31% of the total supply

in 2016. The electrical/electronics industry has become the most important customer in

almost all major Asian markets, e.g. China, Japan, Republic of Korea.

Since 2010, the demand for industrial robots has accelerated considerably due to the

ongoing trend toward automation and continued innovative technical improvements in

industrial robots. Between 2011 and 2016, the average robot sales increase was at 12%

per year (CAGR). The number of robot installations had never increased so heavily

before. Between 2005 and 2008, the average annual number of robots sold was about

115,000 units. 2009 is excluded because of the global economic and financial crisis

which caused an exceptional plunge in robot sales that year. In 2010, robot investments

which had been restrained in 2009 were the main driver of the significant increase.

Between 2011 and 2016, the average annual supply rose to about 212,000 units. This is

an increase of about 84% compared to the average annual supply between 2005 and

2008 and a clear indication of the tremendous rise in demand for industrial robots

worldwide.

Executive Summary World Robotics 2017 Industrial Robots

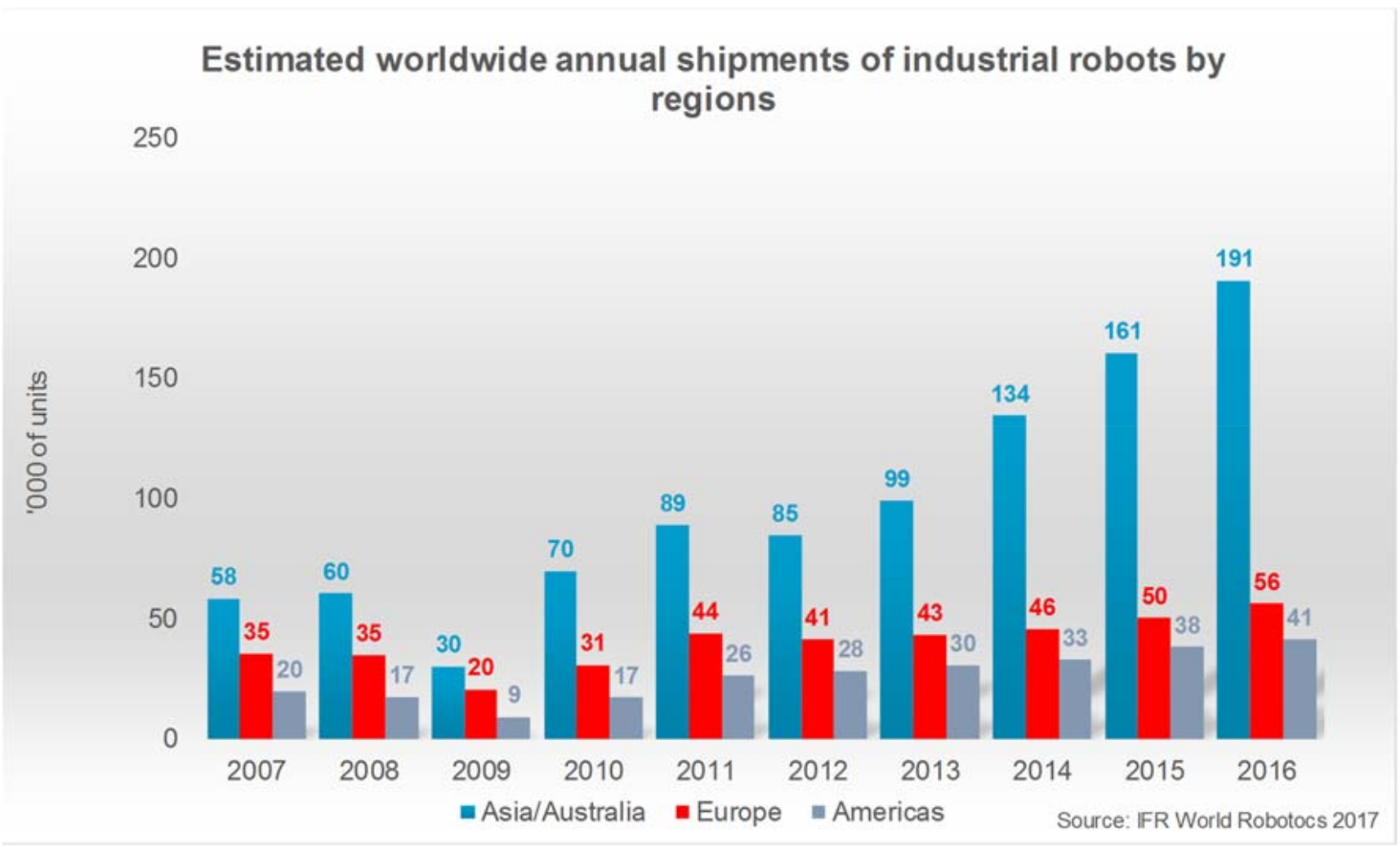

Continued considerable increase in all regions

Asia16 is still the world’s strongest growth market. This region saw a total of 190,492 units

sold in 2016 – a rise of 19%. This was the highest sales level ever recorded for the fourth

year in a row. Industrial robot sales in the second largest market, Europe, increased by

12% to 56,000 units (a new peak, for the third year in a row). About 41,300 industrial

robots were shipped to the Americas, 8% more than in 2015, establishing a new peak

for the fifth year in a row.

74% of the global robot sales in five countries

There are five major markets representing 74% of the total sales volume in 2016: China,

the Republic of Korea, Japan, the United States, and Germany. Since 2013 China

has been the biggest robot market in the world with a continued dynamic growth.

China has significantly expanded its leading position as the biggest market with a share

of 30% of the total supply in 2016 (27% in 2015). With sales of about 87,000 industrial

robots in 2016 – an increase of 27% compared to 2015 – China came close to the total

sales volume of Europe and the Americas together (97,300 units). Chinese robot

suppliers continued to expand their market share from 25% in 2013 to 31% in 2016.

Between 2011 and 2016, total supply of industrial robots increased by about 31% per

year on average. (For more details see chapter 3.3.1.)

About 41,400 units (8% more than in 2015) were sold to the Republic of Korea, the

second biggest market. Due to major investments of the electrical/electronics industry in

robots, annual sales increased considerably in 2016. Between 2011 and 2016, robot

sales increased by 10% on average per year (CAGR). (For more details see chapter

3.3.5.)

In 2016, robot sales in Japan increased by 10% to about 38,600 units, reaching the

highest level since 2006 (37,400 units). Robot sales in Japan followed a decreasing trend

between 2005 (reaching the peak at 44,000 units) and 2009 (sales dropping to only

12,767 units). Between 2011 and 2016, robot sales increased by 7% on average per

year (CAGR). (For more details see chapter 3.3.4.)

Increase in robot installations in the United States continued in 2016, by 14%, to the

peak of 31,400 units. Driver of this continued growth since 2010 was the ongoing trend

to automate production in order to strengthen American industries on the global market

and to keep manufacturing at home, and in some cases, to bring back manufacturing

that had previously been sent overseas. (For more details see chapter 3.2.2.)

Germany is the fifth largest robot market in the world. In 2016, the number of robots sold

increased slightly to 20,039 units compared to 2015 (19,945 units). Between 2011 and

2016, annual sales of industrial robots more or less stagnated at around 20,000 units.

(For more details see chapter 3.4.11.)

16Australia and New Zealand included in the category

Executive Summary World Robotics 2017 Industrial Robots

Other important Asian markets

Since 2013, Taiwan has ranked sixth among the most important robot markets in the

world regarding the annual supply. Robot installations increased considerably between

2011 and 2016, by 15% on average per year (CAGR). In 2016, robot sales increased by

5% to about 7,600 units, a new peak. Thailand is also a growing robot market in Asia.

However, sales have declined since 2014 reaching 2,646 units in 2016. The peak was

reached in 2012 with about 4,000 units. Robot sales increased by 27% to a new peak of

2,627 units in India, almost the same level as in Thailand. Robot supplies to other

Southeast Asian countries like Vietnam, Singapore and Malaysia substantially increased

in 2016. (For more details see chapter 3.3.)

Other important European markets

Italy has ranked 7th since 2014 regarding the worldwide annual supply of industrial

robots. Robot investments were slightly down in 2016 from the peak of 6,700 units in

2015. The French robot market was up by 39% to a new peak level. In Spain, sales of

industrial robots rather moderately increased to a new peak of 3,900 units. Sales of

industrial robots in the United Kingdom increased for the first time since 2012. Robot

installations in all other Western European and in all Nordic countries were

significantly up in 2016, as in 2015. Sales in most Central and Eastern European

markets also increased, except in the Czech Republic and Poland. Sales in Turkey

continued to increase in 2016. (For more details see chapter 3.4.)

Other important American markets

Mexico has become an important emerging market for industrial robots. Robot sales

further increased to about 5,900 units in 2016, again a new peak. In Canada, robot sales

were down from the peak of about 3,500 units in 2015 to 2,300 units in 2016. Robot sales

in Brazil decreased in 2016. (For more details see chapter 3.2.)

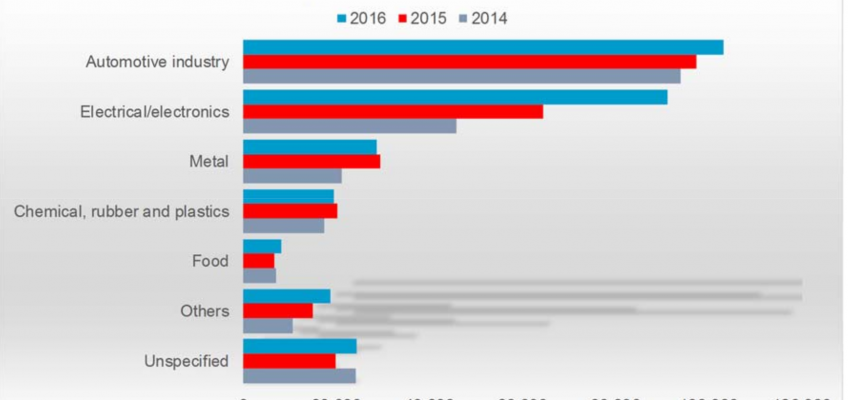

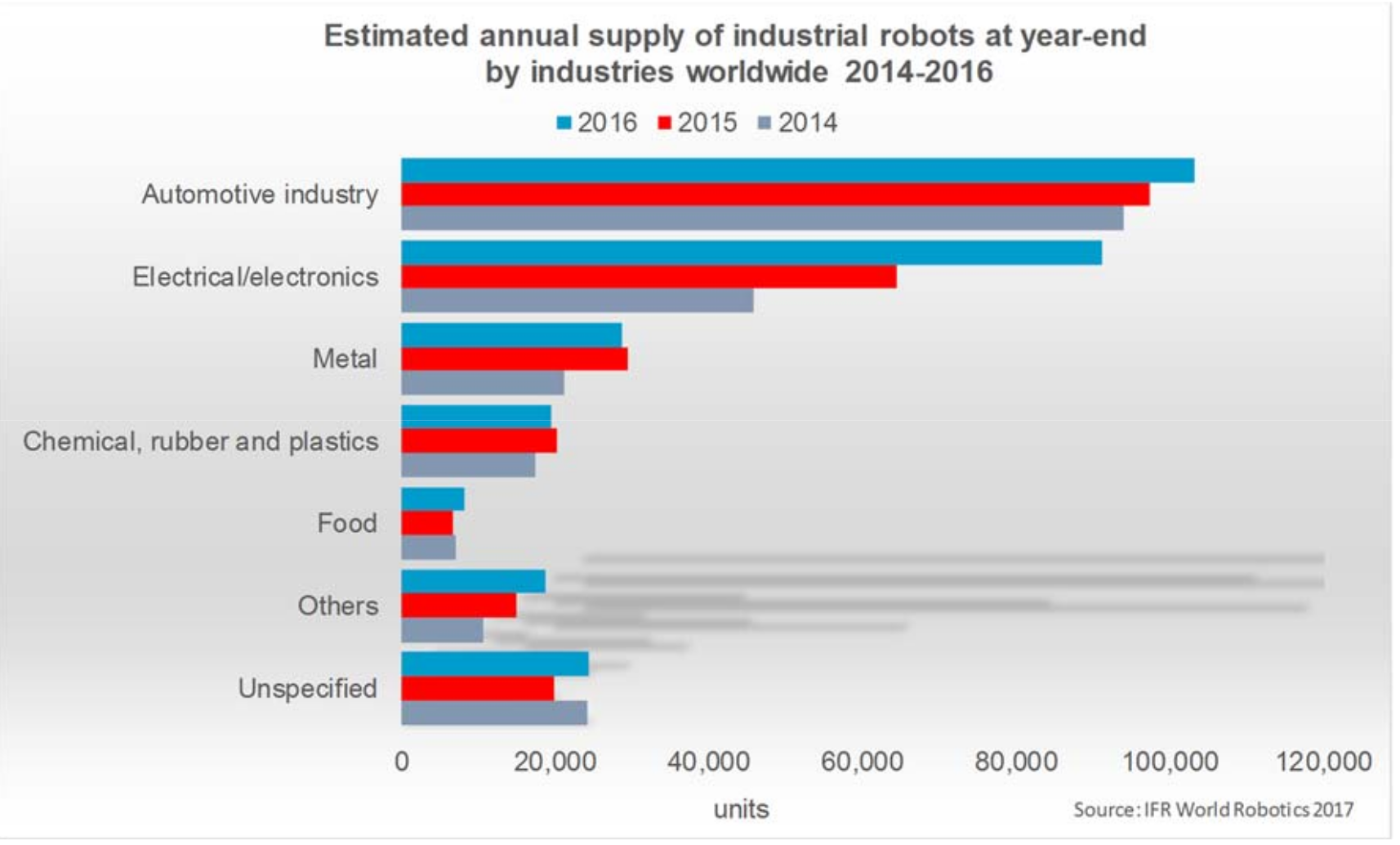

Main driver of the growth: electrical/electronics industry

Between 2010 and 2014, the automotive industry – the most important customer of

industrial robots – considerably increased investments in industrial robots worldwide. In

2015 and in 2016, robot sales further increased but at a lower rate. In 2016, robot

demand of the automotive industry increased by 6% to a new peak of 103,300 units,

accounting for a share of 35% of the total supply in 2016. Between 2011 and 2016, robot

sales to the automotive industry increased by 12% on average per year (CAGR). Since

2010, investments in new production capacities in the emerging markets as well as

investments in production modernization in major car producing countries have caused

the number of robot installations to rise. Using new materials, developing energy efficient

drive systems, as well as high competition in all major car markets, pushed for

investments despite the existing overcapacities.

Executive Summary World Robotics 2017 Industrial Robots

Robot sales to the electrical/electronics industry (including computers and equipment,

radio, TV and communication devices, medical equipment, precision and optical

instruments) were significantly up since 2013. In 2016, sales increased by 41% to a new

peak of 91,300 units, accounting for a share of 31% of the total supply in 2016. Between

2011 and 2016, the average annual growth rate was 19%. The rising demand for

electronic products and new products, the need to automate production and the

increasing need for batteries, chips and displays, were driving factors for the boost in

sales. The production facilities are mainly in Asian countries.

In 2016, sales to the metal and machinery industry slightly decreased by 3% to 28,700

units, down from the peak of 29,450 units in 2015. Since 2010, sales of all subsectors

(basic metals, metal products, industrial machinery) have followed an increasing trend.

Between 2011 and 2016, the average annual growth rate was 15%.

The rubber and plastics industry has continuously increased the number of robot

installations since 2009 from about 5,800 units to 17,300 units in 2015, a new peak. In

2016, sales declined by 8% to 16,000 units. Share of the total supply in 2016 was about

5%. Between 2011 and 2016, sales were up by 9% on average per year. The food and

beverage industry also increased robot orders in 2016 by 20% to almost 8,200 units,

accounting for a share of 3% of the total supply. Sales continuously increased between

2010 and 2014, but it decreased in 2015. The annual average growth rate between 2011

and 2016 was 12%.

Sales to all industries, except for automotive and electrical/electronics, increased by 5%

in 2016. Between 2011 and 2016, the average growth rate per year was 13%. The

respective growth rate for the automotive industry was 12% and for the

electrical/electronics industry 19%. This is a clear indication that not only the main

customer industries (automotive industry and electrical/electronics industry) have

substantially increased robot installations in recent years, but other industries have done

so as well.

Executive Summary World Robotics 2017 Industrial Robots

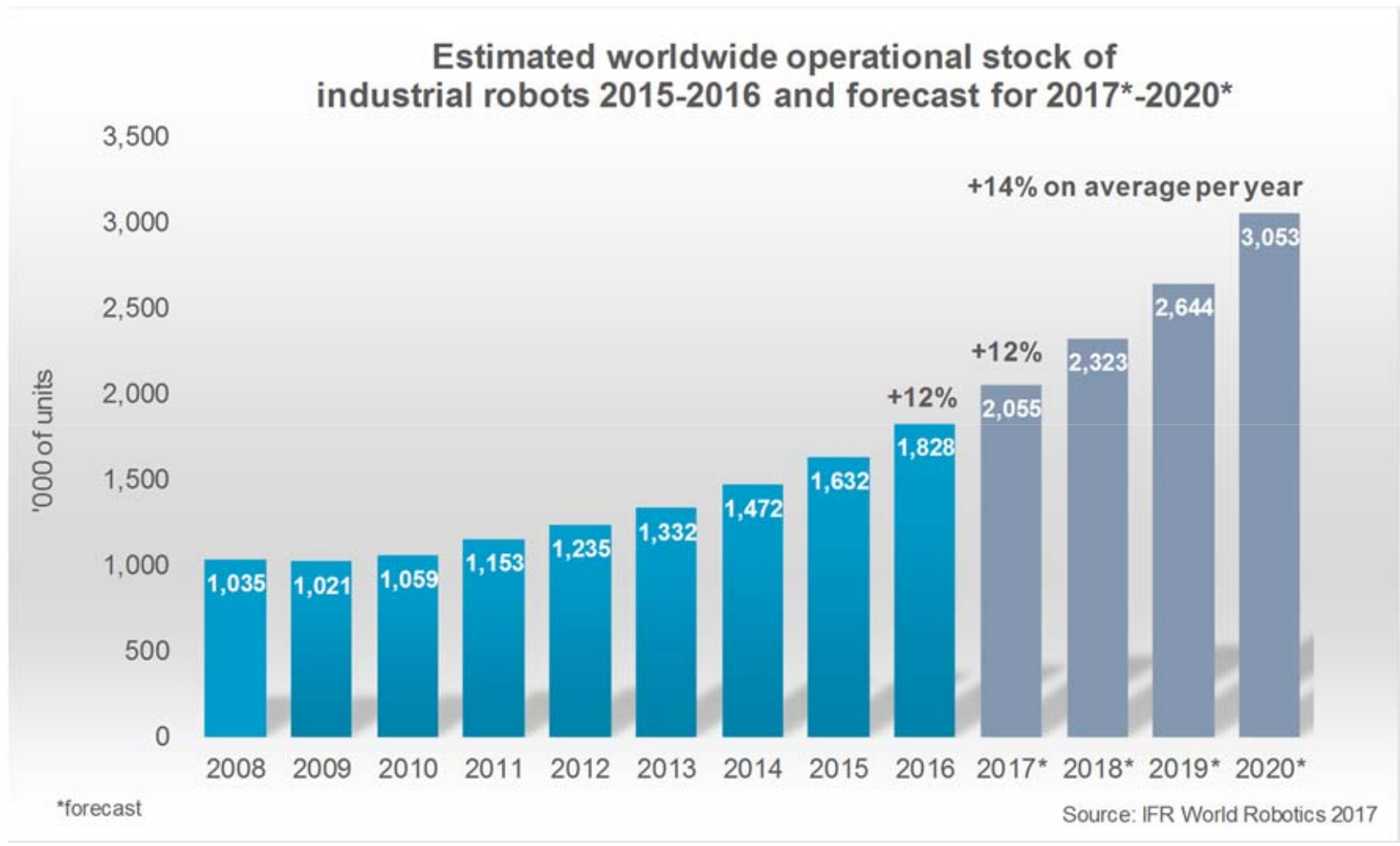

Continued considerable increase of worldwide operational stock

The total worldwide stock of operational industrial robots at the end of 2016 increased

by 12% to about 1.8 million units. Since 2010, the stock has been increasing

considerably by 10% on average per year.

Value of the global market was up to US$13.1. billion

In 2016, the sales value increased by 18% to a new peak at US$13.1 billion. It should be

noted that the figures cited above generally do not include the cost of software,

peripherals and systems engineering. Including the mentioned costs might result in the

actual robotic systems’ market value to be about three times as high. The worldwide

market value for robot systems in 2015 is therefore estimated to be US$40 billion.

Robot density unveils high potential in many countries

When comparing the distribution of multipurpose industrial robots in various countries,

the robot stock, expressed in the total number of units, can sometimes be a misleading

measure. In order to take into account the differences in the size of the manufacturing

industry in various countries, it is preferable to use a measure of robot density. One such

measure of robot density is the number of multipurpose industrial robots per 10,000

persons employed in manufacturing industry or in the automotive industry or in the

“general industry” (which is all industries excluding the automotive industry).

Executive Summary World Robotics 2017 Industrial Robots

The average global robot density is about 74 industrial robots installed per 10,000

employees in the manufacturing industry in 2016. The most automated countries in

the world are the Republic of Korea, Singapore, Germany and Japan.

The Republic of Korea has by far the highest robot density in the manufacturing industry

since 2010. 631 industrial robots were in operation in 2016 per 10,000 employees17. The

rate has been increasing from 311 units in 2010 due to continued installation of a large

volume of robots since 2010 particularly in the electrical/electronics industry and in the

automotive industry. Singapore follows with a rate of 488 robots per 10,000 employees

in 2016. Due to a very low number of employees in the manufacturing industry – some

240,000 employees are estimated by ILO – and a large number of installed robots, the

robot density is very high. About 90% of the robots are installed in the electronics industry

in Singapore, which has increased its number of robot installations significantly in recent

years. Germany ranked third in 2016. The robot density continued to increase to 309

units in 2016. In 2016, Japan ranked fourth for the first time. Up to 2009 Japan had the

highest robot density worldwide. But since 2010 the Republic of Korea and since 2015

Singapore have topped Japan in this respect. Japan’s robot density has been declining

since 2009. In 2016, 303 robots were installed per 10,000 employees in the

manufacturing industry.

The development of the robot density in China was the most dynamic one in the world

due to the significant growth of robot installations in recent years. Particularly between

2013 and 2016, the rising rate of robot density accelerated in China, from 25 units to 68

units. Due to the dynamic development of robot installations since 2010, the robot density

in the United States increased significantly from 114 installed robots per 10,000

employees in the manufacturing industry in 2009 to 189 robots in 2016.

In 2016, the average robot density in the following regions was: 99 units in Europe, 84

in the Americas and only 63 in Asia.

The considerable high rate of automation of the automotive industry compared to all

other sectors is demonstrated in the evaluation of the number of industrial robots in

operation per 10,000 employees in automotive industry and in all other industries.

There was a considerable revision of employment data in the automotive industry in the

Republic of Korea based on updated information from the Ministry of Employment and

Industry. As a result, there was a higher number of installed robots per 10,000 employees

in the automotive industry in the Republic of Korea. 2,145 industrial robots were in

operation per 10,000 employees in 2016. This is more than double the volume in 2009

(1,057) and by far the highest level ever reached. Since 2014, a significant number of

industrial robots have been sold to the automotive industry in the Republic of Korea.

Huge projects aimed at manufacturing batteries for hybrid and electro cars might be the

reason for this high increase in robot density. In 2016, the United States ranked second

with 1,261 industrial robots per 10,000 employees in the US automotive industry. It is

17 Revised robot density rate 2010 – 2015 due to updated information on the number of employees

in the manufacturing industry from the Korean Ministry of Employment and Industry.

Executive Summary World Robotics 2017 Industrial Robots

followed by Japan which had the highest robot density up to 2012 (1,562 robots per

10,000 employees in the automotive industry). Since then, the rate has been decreasing

to 1,240 robots in 2016. France reached a robot density of 1,150 units, Germany 1,131

units and Spain 1,051 units.

The robot density in the automotive industry in China has increased significantly since

2007 but compared to countries like Korea, Germany, and the United States, it is still on

a rather moderate level (505 units).

The robot density in the general industry (all industries excluding automotive) is still

comparatively low. However, countries with an important electronics industry have a

higher rate. The Republic of Korea is on top with 475 robots installed per 10,000

employees. It is followed by Japan with 214 robots, Germany with 181, Sweden with 164

units. Germany and Sweden do not have any important production sites regarding the

electronics industry. The comparatively high rate in both countries is due to a more

diversified distribution of industrial robots in all industries. The increasing automation in

the production of electronic devices will push robot installations within the related

production hubs, particularly in Asian countries. Most of the emerging robot markets have

a robot density rate that is below 30.

The overall conclusion indicates that in almost all surveyed countries, the potential for

robot installations in the general industry is tremendous. It is also considerably high in

the automotive industry among the emerging markets and in some traditional markets

as well. Moreover, continued necessary modernization and retooling also guarantee

further robot investments in already highly automated countries. Relocation of

productions abroad may result in declining investments in that country. However, robot

investments will be shifted to the new production base in another country.

Bright and challenging prospects for industrial robot installations:

Industry 4.0, linking the real-life factory with virtual reality, will play an increasingly

important role in global manufacturing.

Collaborative robots, IoT and Machine Learning/AI will lead robotics in the coming

years.

The new generation of lightweight robots enables man and machine to work closely

and safely together – without fences.

Robots will acquire or adapt new skills through learning processes.

Smarter robots with a “brain” in the cloud as a basis will benefit from big data and

collective learning.

Simplifications – Ready to use applications are getting more popular with the

customers.

Global competition requires continuous modernization of production facilities.

Energy-efficiency and using new materials require continuous retooling of

production.

Growing consumer markets require expansion of production capacities.

Executive Summary World Robotics 2017 Industrial Robots

Decline in products’ life cycle and increase in the variety of products require flexible

automation.

Continuous quality improvement requires sophisticated high tech robot systems.

Robots improve the quality of work by taking over dangerous, tedious and dirty jobs

that are not possible or safe for humans to perform.

Continued strong demand from the automotive industry – investments in eco-friendly

driving systems.

Increasing demand from the electrical/electronics industry.

Increasing demand from the metal and machinery industry, the rubber and plastics

industry, the food and beverage industry.

Small and medium sized companies will increasingly use industrial robots.

China will remain the main driver of the growth.

Continued considerable increase of robot installations in all other growing Asian robot

markets, e.g. India, Taiwan and other Southeast Asian markets.

Continued increase in Japan and in the Republic of Korea.

Continued significant increase in North America – general industry catching up.

Accelerating growth of robot sales in Central and Eastern Europe.

Continued growth of robot sales in Western Europe.

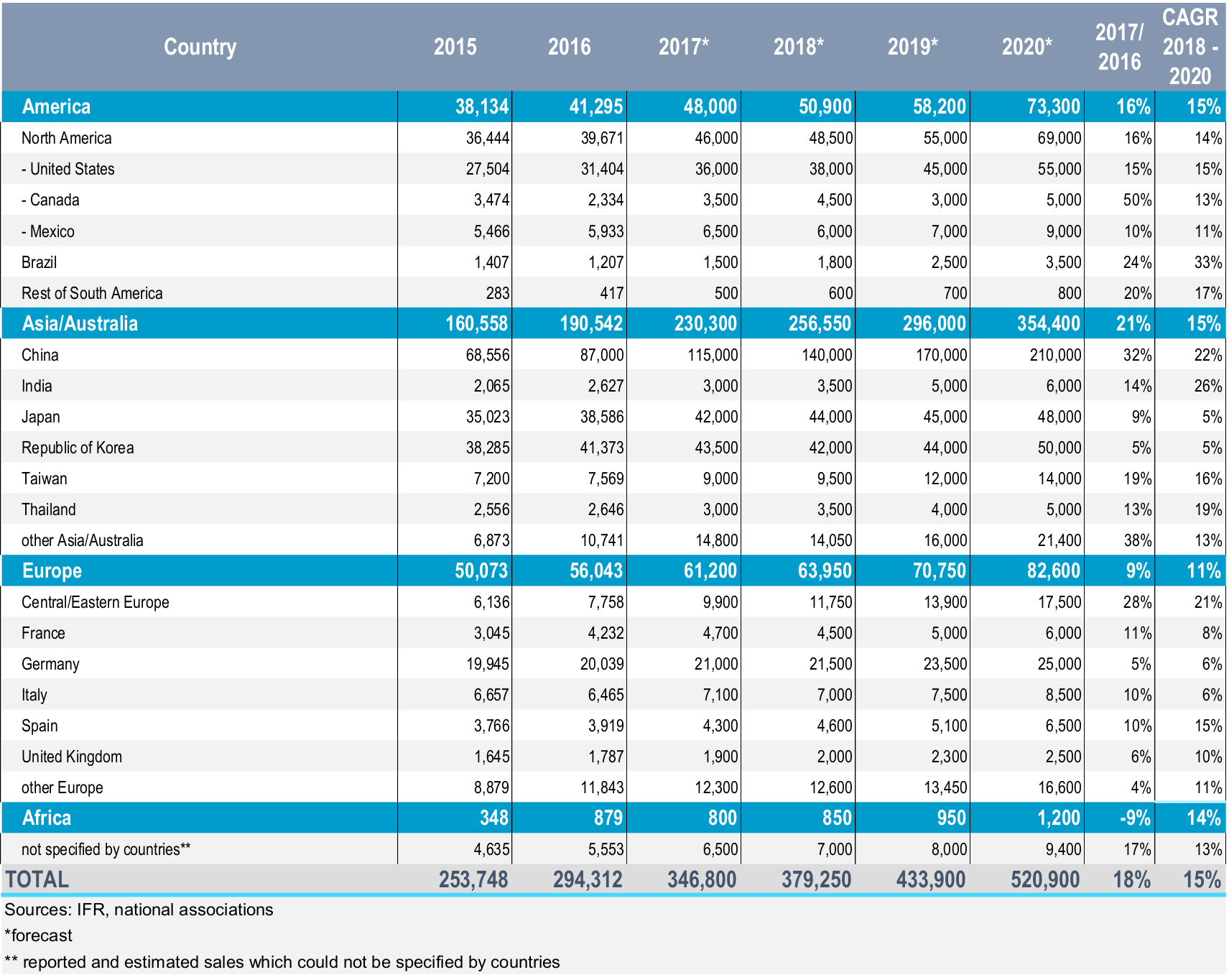

Global robot installations are estimated to increase at least by 18%, to about

346,800 units in 2017. Robot supplies in the Americas will increase by 16%, in

Asia/Australia by 21%, and in Europe by 8%.

From 2018 to 2020, global robot installations are estimated to increase by at least 15%

on average per year (CAGR): 15% in the Americas and in Asia/Australia, and 11% in

Europe. Total global sales will reach about 520,900 units in 2020. Between 2017 and

2020, it is estimated that more than 1.7 million new industrial robots will be installed in

factories around the world.

Executive Summary World Robotics 2017 Industrial Robots

Table 4.1 Estimated annual shipments of multipurpose industrial robots in selected countries.

Number of units

It is estimated that the worldwide stock of operational industrial robots will increase

from about 1,828,000 units at the end of 2016 to 3,053,000 units at the end of 2020,

Executive Summary World Robotics 2017 Industrial Robots

representing an average annual growth rate of 14% between 2018 and 2020. In 2016,

the stock increased by 12% to about 1.8 million units.

The operational stock of robots in 2017 is estimated to increase by 9% in the Americas,

by 16% in Asia/Australia, and by 7% in Europe. Between 2018 and 2020, the stock will

increase by 12% on average per year in the Americas, by 17% in Asia/Australia, and by

7% in Europe.